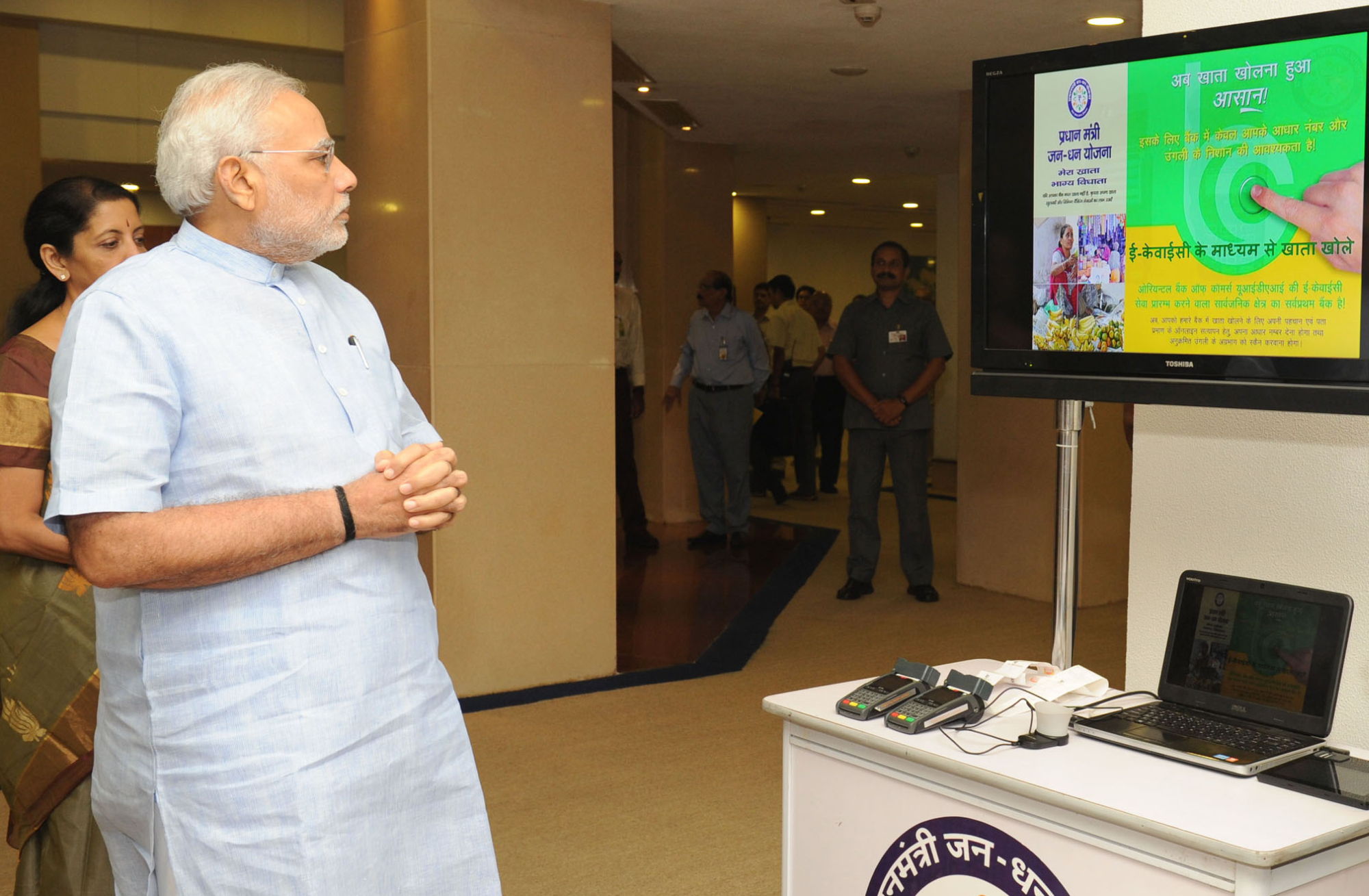

The Prime Minister Narendra Modi today declared the beginning of the end of financial untouchability in India, with the opening of an estimated 1.5 crore bank accounts across the country, in an exercise unprecedented in scale in economic history.

Formally launching the Pradhan Mantri Jan Dhan Yojana (PMJDY) at a function broadcast across the nation from Vigyan Bhawan in New Delhi, the Prime Minister described the occasion as a festival to celebrate the liberation of the poor from a poisonous cycle. (Vish-chakra se gareebon ki aazaadi ka parv)

Expressing satisfaction at a number of records being broken today, the Prime Minister said the nationwide success of the enrolment drive today would give confidence not just to the officials of the Department of Financial Services and banking sectors, but also to officers across the Union Government, that they can successfully achieve the goals that they set for themselves.

The Prime Minister said that though the initial target of PMJDY was to open bank accounts for 7.5 crore families in one year, he had exhorted the concerned officials to complete the task before the next Republic Day.

Elaborating the benefits under PMJDY, the Prime Minister said this was not a mere bank account, but had other benefits including an RuPay debit card, Rs 1 lakh accident insurance cover, and an additional Rs. 30,000/- life insurance cover for those opening bank accounts before January 26th, 2015. He said the account performance would be monitored and overdraft facility would be given. The Prime Minister said he had sent 7.25 lakh bank employees, exhorting them to help reach the target of 7.5 crore bank accounts, and bring freedom from financial untouchability.

Chief Minister Virbhadra Singh launched State Level Pradhan Mantri Jan Dhan Yojna (PMJDY), at Shimla.

After the launching of the Scheme Chief Minister said that it would go a long way in strengthening the socio-economic development and would provide several other benefits to the people and associate the people of the State with the Banking system.

Initially every account holder will get a RuPay debit card with rupees One lakh as accident cover to the poor besides there was also provision of micro loan to women upto Rs.5000, said he.

Chief Minister said that main objective of the scheme was to provide banking facility to the poorest of the poor so that in case of any financial emergency they could be provided relief through the scheme. This would help in economic empowerment of the poor.

Chief Minister said that the Banks had played pivotal role in strengthening of the economy of the people particularly in agriculture and Rural development sector in Himachal Pradesh.

He said that there were 1827 branches of banks in the State out of which 1460 branches were functioning in rural areas. As against the National average of one branch per 13,000 people, the State boasts of having one branch per 3575 people, which was far better than the National level and indicates about the wide network of banks in the State.

Harsh Mahajan, Chairman HP State Co-operative Bank, Chief Secretary, P Mitra, Principal Secretary Finance, Dr. Shrikant Baldi, KK Verma Chief Manager, UCO Bank, senior officers of the State Government and the Banking Institutions and representative of the Panchayats were also present on the occasion amongst the others.