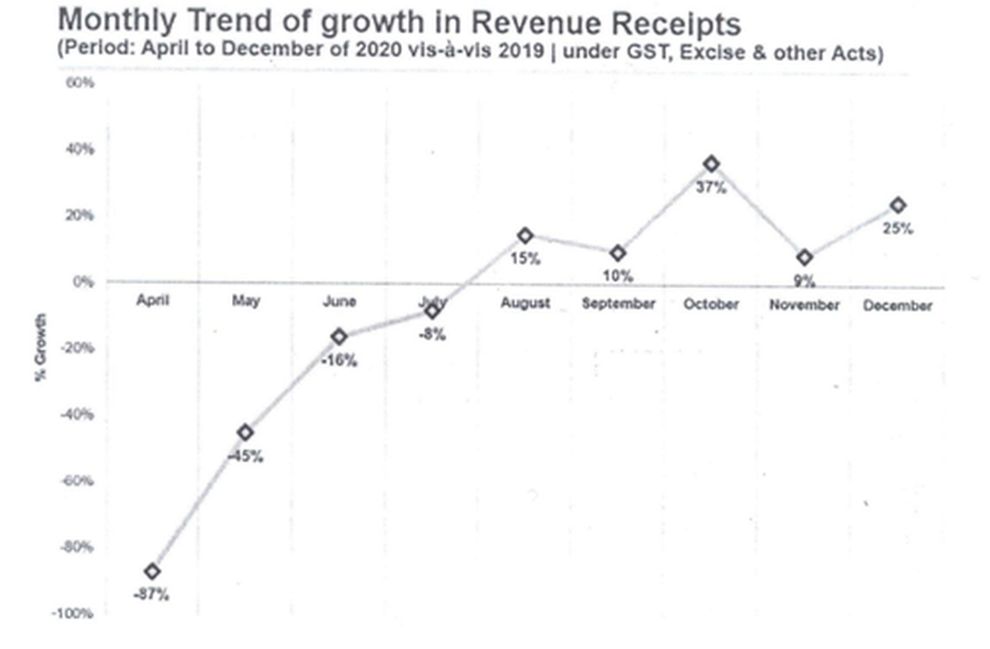

Shimla: Showing a sign of recovery, Himachal Pradesh has registered 25 percent growth for the month of December 2020 in revenue receipts under all heads of the Excise and Taxation department vis-a-vis the revenue receipts of December 2019.

Chief Minister Jai Ram Thakur, in a press statement, revealed that “total revenue receipts during the month of December 2020 are Rs. 772 crores against Rs. 619 crores during the same period of last year. This continues the positive trend of last four months. The revenue receipts of the department grew at 15 percent in August 2020, 10 percent in September 2020, 37 percent in October 2020 and nine percent in November, 2020.”

Chief Minister said that a significant increase of 45 percent in revenue receipts of VAT, 29 percent in revenue receipts of excise and 16 percent in revenue receipts of the state GST have been registered in December 2020.

The significant increase in revenue receipts has been due to revival of economic activities, government’s unlock strategy, better compliance by taxpayers and better administration by the department, the CM further added.

It is important to mention that despite of COVID-19 effect, the gap between cumulative revenue of current financial year and previous financial year was down to seven percent in December 2020 from 39 percent in July 2020.

Further, new initiatives of monitoring of field units through performance cards have created healthy competitive work environment across the field authorities where each authority drives motivation to make strenuous efforts to beat the assigned targets. This has contributed significantly in augmentation of state revenue receipts. The efforts of the field units have further been strengthened with the enhanced analytical and data driven intelligence-based capabilities at headquarter level.

Jai Ram Thakur said that major focus areas have been identified for augmenting the state revenue receipts like recoveries under legacy cases resolution scheme, physical verifications of e-way bills, compliance of GSTR3B return fillings, recovery of interest for late filling of returns, recovery of ineligible ITCs and recovery of tax deficits/mismatches etc.

He added that special focus has been laid on identification of cases pertaining to tax evasions and erroneous refunds to plug revenue leakages so as to augment the state revenues.