Himachal’s Loan Repayment Challenge: Rs 70,718 Crore Due in Next Five Years; State Government Pushes for Interest-Free Loans

The economy of Himachal Pradesh is currently grappling with an escalating debt crisis. The state government’s recent presentation to the 16th Finance Commission has laid bare the financial predicament, showing that the total debt has soared to Rs 94,992 crore for the current financial year. With Rs 70,718 crore due to be repaid over the next five years, including a staggering Rs 44,617 crore in interest alone, the urgency for solutions has never been more pronounced.

The state government has outlined the dire need for assistance from the Finance Commission, particularly in light of the central government’s decision not to increase the loan limits for states. Himachal Pradesh has been receiving an average annual loan limit of nine to ten thousand crores, which has proven insufficient to cover its mounting financial obligations.

A report by the Reserve Bank of India underscores the gravity of the situation, highlighting the surge in the state’s total debt. Compounding the issue, implementing the new pay commission and the old pension scheme has inflated the salary and pension bill by 59 percent. This significant increase in committed expenditures has further strained the state’s finances.

The state’s reliance on loans has shifted markedly towards open-market borrowing. In the financial year 2018-19, 44 percent of the state’s loans were sourced from the market, but this figure had climbed to 53 percent by 2022-23. The loan limit for the current financial year is around Rs 6200 crore until December 2024. Alarmingly, the Himachal government has already utilized half of this limit within the first two months, raising serious concerns about financial sustainability throughout the year.

The state budget for this year stands at Rs 58,444 crore, but with Rs 42,079 crore allocated for committed expenditures such as salaries, pensions, and loan repayments, the financial flexibility is severely constrained. Efforts to boost revenue through measures like the water cess have faced legal hurdles, and the provision of freebies has exacerbated the financial strain.

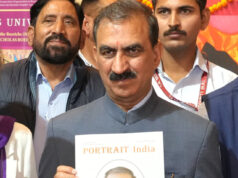

In response to this crisis, the Himachal Pradesh government has proposed a new formula to the 16th Finance Commission aimed at debt servicing and fulfilling the state’s financial needs. The state has urged the commission to relax the conditions for loans, citing Himachal’s strong human development indicators. Specifically, the state government has recommended that the expensive National Small Savings Fund (NSSF) loans be made cheaper, swapped for market loans, or waived entirely. Additionally, it has called for old loans from the Government of India to be made interest-free or forgiven altogether. The state has also requested the continuation of the interest-free loan scheme for up to 50 years, initiated by the Government of India for capital expenditure post-COVID-19.

As Himachal Pradesh navigates this precarious financial landscape, the response from the 16th Finance Commission will be crucial. The state’s economic stability and growth trajectory in the coming years hinge on the support and flexibility extended by the Union government.