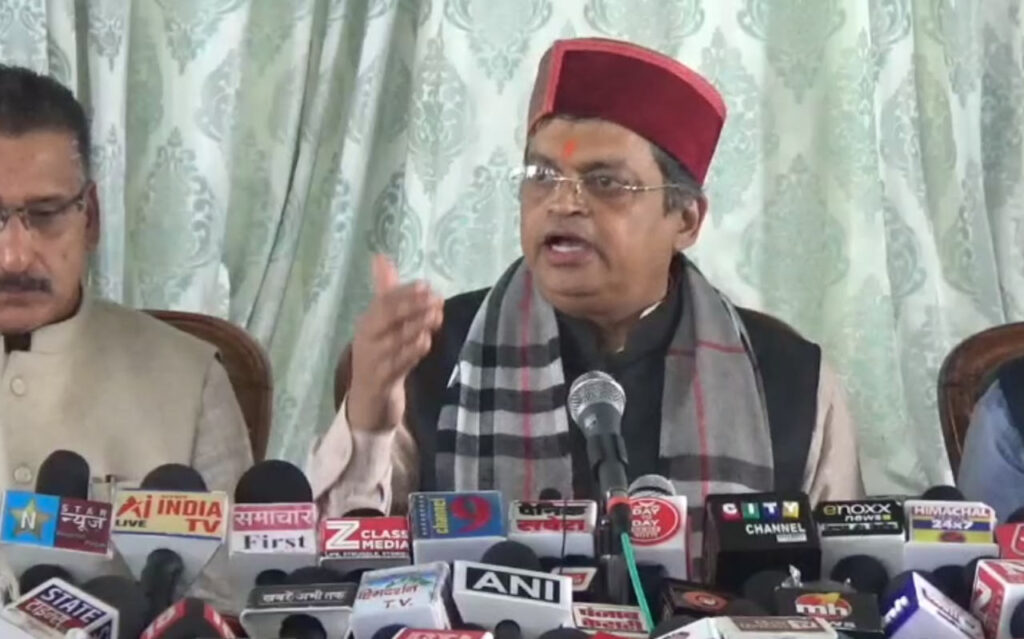

Shimla – BJP national spokesperson Gopal Krishna Aggarwal has asserted that Himachal Pradesh is witnessing steady growth in GST collections and is not incurring any losses under the current tax system. He said the state’s GST revenue has been increasing by 14% every year, countering the Congress government’s claims of financial strain due to GST.

Presenting figures at a press conference in Shimla, Aggarwal said that for 2023-24, Himachal Pradesh received ₹5,339 crore from its share of GST and ₹2,845 crore from Integrated GST (IGST), totaling ₹9,375 crore. In addition, the Centre provided ₹14,942 crore as grants-in-aid, taking the total support to ₹24,317 crore in one year. “With a total state budget of ₹50,000 crore, this means that half of Himachal’s budget is coming directly from the Centre,” he said.

He argued that the Congress government’s repeated claims of insufficient funds are misleading. “If 50% of the state’s budget is being funded by the Centre, the Himachal government should stop spreading a negative narrative. The Union government stands firmly with the people of Himachal,” Aggarwal said.

The BJP spokesperson also referred to past revenue figures, noting that the state received ₹4,753 crore in 2020-21, ₹7,349 crore in 2021-22, and ₹7,883 crore in 2022-23 from GST collections. “This is not a small amount. Simply alleging losses due to GST is not a proof of the truth,” he remarked, while pointing out that Himachal spends 39% of its resources on salaries, 23% on pensions, and 15% on interest payments.

Aggarwal further highlighted the launch of the Next Gen GST reform, which he said would simplify tax compliance and benefit both traders and consumers. Key changes include reducing GST to two slabs – 5% and 18% covering 99% of goods, faster registration for businesses within three days, immediate release of 90% of refunds, and resolution of inverted duty and input tax credit issues.

“Prime Minister Narendra Modi has described this as a ‘GST Savings Festival,’ reflecting the spirit of Janata Devo Bhava. These reforms will make essential goods cheaper, support farmers with lower taxes on agricultural equipment, and boost industry by increasing demand,” Aggarwal said.

He added that the GST system, implemented in 2017 as “India’s economic independence day,” has strengthened the principle of One Nation, One Tax. “Today India collects over ₹2 lakh crore per month through GST, which has become one of the most effective tax regimes in the world,” he said, expressing confidence that the reforms will further energise India’s economy and strengthen the vision of a self-reliant, developed nation.