Finance Department flags Rs 6,000 crore shortfall even after Rs 10,000 crore borrowing as Revenue Deficit Grant discontinued

Shimla – The discontinuation of the Revenue Deficit Grant (RDG) by the Union government has pushed Himachal Pradesh into a serious financial crisis, leaving the state struggling to meet even its basic and committed expenditures. The grant earlier contributed nearly 13 per cent of the state’s total budgetary requirement and acted as a crucial support system for managing salaries, pensions and essential welfare schemes.

With the Revenue Deficit Grant now withdrawn, the state government is facing an uncertain future. Officials have warned that arranging funds for employee salaries and pensions itself may become difficult, while development works are likely to take a major hit due to the shrinking fiscal space.

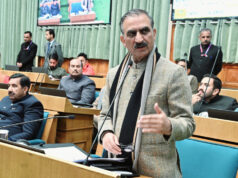

The gravity of the situation was outlined in a detailed presentation made by the Finance Department before the Cabinet on the state’s financial position and the impact of the abolition of the Revenue Deficit Grant. The department also presented its assessment of the likely consequences of the 16th Finance Commission’s report.

During the presentation, Principal Secretary Finance Devesh Kumar said that the Revenue Deficit Grant was a constitutional provision under Article 275(1) and had been provided to Himachal Pradesh till the 15th Finance Commission. Under this framework, the Finance Commission assesses the revenue and expenditure of states and recommends gap-filling grants wherever a deficit exists after tax devolution.

He explained that for the period from 2021 to 2026, Himachal Pradesh’s revenue was assessed at Rs 90,760 crore, while its expenditure was assessed at Rs 1,70,930 crore. This left a deficit of Rs 80,170 crore. The gap was bridged through tax devolution of Rs 35,064 crore, Revenue Deficit Grant of Rs 37,199 crore and other grants amounting to Rs 9,714 crore. However, the 16th Finance Commission did not assess the revenue and expenditure of individual states, resulting in the complete discontinuation of RDG.

At present, the state’s own revenue is around Rs 18,000 crore, while its committed expenditure is close to Rs 48,000 crore. This expenditure includes salaries, pensions, loan interest and principal repayment, subsidies and social security pensions. The share in central taxes is projected at Rs 13,950 crore. Even after adding borrowings of Rs 10,000 crore, the total resources available to the state are estimated at around Rs 42,000 crore, which is still insufficient to meet mandatory obligations.

The Finance Department has estimated a clear resource gap of about Rs 6,000 crore in 2026-27, even after excluding development works, pending liabilities and state-specific schemes. Officials cautioned that suggested measures such as stopping subsidies, rethinking the Old Pension Scheme in favour of a universal pension model, or delaying dearness allowance and arrears cannot be implemented in a short time. Even if reforms to raise revenue and cut expenditure are carried out, the financial gap is expected to persist.

The department stressed that the Revenue Deficit Grant had acted as a financial saviour for Himachal Pradesh. Research and past Finance Commission reports have consistently recognised that hill states face structural disadvantages due to difficult terrain, higher infrastructure costs, limited industrial growth and low tax buoyancy. These constraints make them heavily dependent on central support for fiscal stability.

Himachal Pradesh was granted Special Category Status precisely because it was formed on public aspiration and administrative need, not as a financially viable unit. Experts point out that the withdrawal of gap-filling support like Revenue Deficit Grant forces hill states to cut development spending first, widening regional imbalances and slowing economic growth.

The Finance Department warned that the impact of the withdrawal of the Revenue Deficit Grant is not limited to the present government. It will affect future governments as well and may lead to prolonged fiscal stress. Officials described the decision as a grave injustice to the people of Himachal Pradesh, arguing that the state’s special needs and constitutional safeguards have been ignored, pushing it closer to a fiscal collapse.