Welcomes decision to increase threshold limit from 10 lakh to Rs 20 lakh

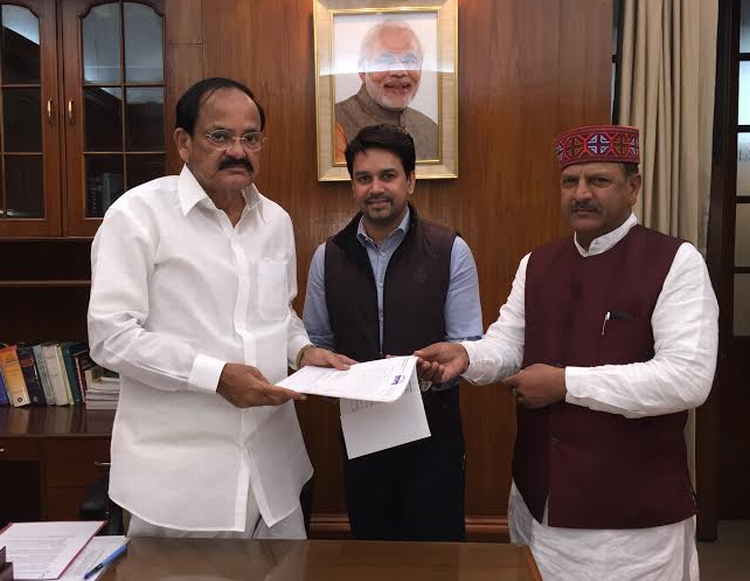

Himachal Pradesh Chief Minister Jai Ram Thakur hailed the decision of the Union Government to increase the threshold limit for registration of dealers from Rs. 10 lakh to Rs. 20 lakh per annum.

The Chief Minister believed the decision of the Union Government would go a long way in providing much needed relief to the businessmen of the State.

Jai Ram Thakur said the State Government has urged the Union Government to enhance the limit for the businessmen of the State keeping in view its difficult topographical conditions along with some other hilly states like Assam and Uttarakhand. He said that now most of the special category states would come under Rs. 20 lakh threshold limit for registration of dealers thereby benefitting lakhs of businessmen.

Chief Minister said that about 75 to 80 per cent businessmen were small businessmen in the State and they would be immensely benefitted from this decision of the Union Government. He said that till date, over 92000 dealers have already registered under GST and out of these over 80 per cent would be benefitted as they would be required to file lesser number of returns per annum.

Chief Minister said that apart from this major decision, the Centre Government has also agreed that all the Business Concerns with annual turnover up to Rs. 5 crores would now be required to file quarterly returns. Earlier this limit was Rs. 1.5 crores and the businessmen were facing difficulty in and would now be relieved from the pressure of filing many returns on small businesses, he said.

Jai Ram Thakur said the decision of the Union Government to reduce GST rates on washing machines, refrigerators mixers, footwear etc. would also provide much needed relief to middle classes. He said that the decision to exempt GST on Sanitary napkins would benefit the health and hygiene of women. Earlier, 12 percent GST was being charged on sanitary napkins making it quite expensive, he said.

Earlier yesterday, in the 28th meeting of the GST Council, recommended amendments in the CGST Act, IGST Act, UTGST Act and the GST (Compensation to States) Act.

1. Upper limit of turnover for opting for composition scheme to be raised from Rs. 1 crore to Rs. 1.5 crore. Present limit of turnover can now be raised on the recommendations of the Council.

2. Composition dealers to be allowed to supply services (other than restaurant services), for upto a value not exceeding 10% of turnover in the preceding financial year, or Rs. 5 lakhs, whichever is higher.

3. Levy of GST on reverse charge mechanism on receipt of supplies from unregistered suppliers, to be applicable to only specified goods in case of certain notified classes of registered persons, on the recommendations of the GST Council.

4. The threshold exemption limit for registration in the States of Assam, Arunachal Pradesh, Himachal Pradesh, Meghalaya,Sikkim and Uttarakhandto be increased to Rs. 20 Lakhs from Rs. 10 Lakhs.

5. Taxpayers may opt for multiple registrations within a State/Union territory in respect of multiple places of business located within the same State/Union territory.

6. Mandatory registration is required for only those e-commerce operators who are required to collect tax at source.

7. Registration to remain temporarily suspended while cancellation of registration is under process, so that the taxpayer is relieved of continued compliance under the law.

8. The following transactions to be treated as no supply (no tax payable) under Schedule III:

a. Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods enteringinto India;

b. Supply of warehoused goods to any person before clearance for home consumption; and

c. Supply of goods in case of high sea sales.

9. Scope of input tax credit is being widened, and it would now be made available in respect of the following:

a. Most of the activities or transactions specified in Schedule III;

b. Motor vehicles for transportation of persons having seating capacity of more than thirteen (including driver), vessels and aircraft;

c. Motor vehicles for transportation of money for or by a banking company or financial institution;

d. Services of general insurance, repair and maintenance in respect of motor vehicles, vessels and aircraft on which credit is available; and

e. Goods or services which are obligatory for an employer to provide to its employees, under any law for the time being in force.

10. In case the recipient fails to pay the due amount to the supplier within 180 days from the date of issue of invoice, the input tax credit availed by the recipient will be reversed, but liability to pay interest is being done away with.

11. Registered persons may issue consolidated credit/debit notes in respect of multiple invoices issued in a Financial Year.

12. Amount of pre-deposit payable for filing of appeal before the Appellate Authority and the Appellate Tribunal to be capped at Rs. 25 Crores and Rs. 50 Crores, respectively.

13. Commissioner to be empowered to extend the time limit for return of inputs and capital sent on job work, upto a period of one year and two years, respectively.

14. Supply of services to qualify as exports, even if payment is received in Indian Rupees, where permitted by the RBI.

15. Place of supply in case of job work of any treatment or process done on goods temporarily imported into India and then exported without putting them to any other use in India, to be outside India.

16. Recovery can be made from distinct persons, even if present in different State/Union territories.

17. The order of cross-utilisation of input tax credit is being rationalised.