The practice of female foeticide, driven by the archaic and flawed mindset of having preference for a male child, has attained genocidal proportions in India. The country recorded a child sex-ratio of 914 in the 2011 census – the lowest ever since attaining Independence.

The situation was described as an “emergency” in a report published in the same year by the United Nations. The report attributed much of the declining numbers to illegal abortions throughout the country.

While calling for immediate measures to deconstruct the male dominated social structure of the country, the report also mentioned that education could be the key to achieve this and both schooling and higher education are important factors that need to be studied further in influencing sex ratios.

The Central Government launched the “Beti Bachao, Beti Padhao” scheme in January 2015 with the aim of bringing about an overall positive change in the mindsets of the people and to end discrimination against the girl child. Through this scheme, the government would sensitise the citizens of this country towards the concerns of the girl child and women, thereby leading to the larger goal of gender equality.

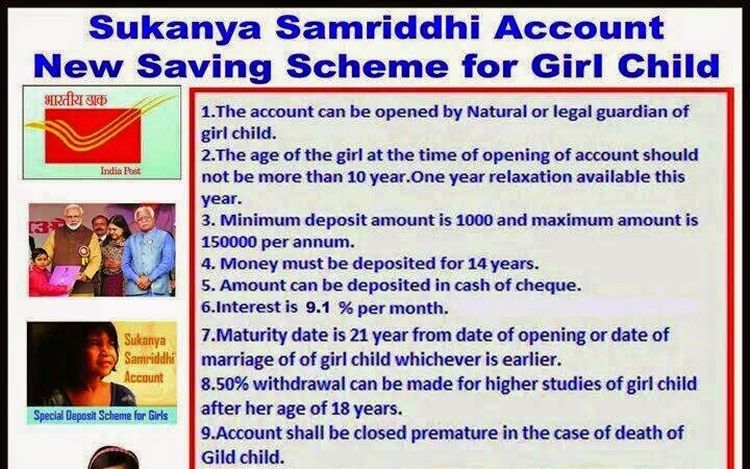

Along with the Beti Bachao, Beti Padhao scheme, the government also launched the “Sukanya Samriddhi Account” programme. Although a lot has been written and said about the former, the latter has not been in the news much and has not received much attention from the masses.

Despite being a small savings scheme, the Sukanya Samriddhi Account has the potential to have a phenomenal impact on the lives and self esteem of young girls in the country. The scheme aims to ensure a bright future for the girl children by facilitating their education and marriage expenses.

Under the scheme, a parent or legal guardian can open an account in the name of the girl child until she attains the age of ten years. As per the government notification on the Scheme, the account can be opened in any post office branch and designated public sector banks.

The banks that have been authorized to open accounts under the scheme are: State Bank of India, State Bank of Mysore, State Bank of Hyderabad, State Bank of Travancore, State Bank of Bikaner & Jaipur, State Bank of Patiala, Vijaya Bank, United Bank of India, Union Bank of India, UCO Bank, Syndicate Bank, Punjab National Bank, Punjab & Sind Bank, Oriental Bank of Commerce, Indian Overseas Bank, Indian Bank, IDBI Bank, ICICI Bank, Dena Bank, Corporation Bank, Central Bank of India, Canara Bank, Bank of Maharashtra, Bank of India, Bank of Baroda, Axis Bank, Andhra Bank and Allahabad Bank.

The rate of interest for the scheme is an attractive 9.2 per cent which will be compounded annually. This rate, however, will be revised every year by the government and will be announced at the time of the Union Budget. The minimum deposit that needs to be made every year is Rs 1,000, and the maximum amount that can be deposited in a year is Rs 1,50,000. There is no limit on the number of deposits either in a month or in a financial year.

The account will be valid for 21 years from the date of opening, after which it will mature and the money will be paid to the girl child in whose name the account had been opened. If the account is not closed after maturity, the balance amount will continue to earn interest as specified for the scheme from time to time. The account will also automatically close if the girl child gets married before the completion of the tenure of 21 years.

Deposits can be made up to 14 years from the date of opening of the account. After this period the account will only earn interest as per applicable rates.

In case the required minimum annual deposit of Rs 1,000 is not made by a parent or a guardian, the account will cease to be active. In such a situation, the account can be easily reactivated by paying a penalty of Rs 50 per year along with the minimum amount required for deposit for that year.

Premature withdrawal – withdrawing money before the completion of the maturity period of 21 years – can only be made by the girl child in whose name the account has been opened after she attains the age of 18 years. This withdrawal will also be limited to 50 per cent of the balance standing at the end of the preceding financial year, and will only be allowed for the purpose of higher education or if the girl intends to get married. It is also worthy to note that in order to make a withdrawal, the account should have a deposit of at least 14 years or more.

A parent or guardian can open only one account per girl child, and a maximum of two such bank accounts in the name of two girl children. In case of twin girls as second birth, or if the first birth itself results in the birth of three girl children, three bank accounts can be opened in the name of three girl children.

Tax exemption is one of the greatest advantages of the Sukanya Samriddhi Account programme. The deposits made to the account, and also the proceeds and maturity amount would be fully exempted from tax under section 80C of the Income Tax Act.

The account can be prematurely closed only under two circumstances. In case of the unfortunate death of the girl child (account holder), the parent or legal guardian can claim for the accumulated amount along with the interest accrued on the account. The balance would be immediately handed over to the nominee of the account.

The second condition under which the account can be prematurely closed is when the competent authorities feel and confirm that it is not possible for the depositor to carry forward the account or the contributions made towards the account are causing undue hardships to the depositor. There is no third condition under which the account can be closed.

The process of opening an account under the scheme is quite simple and only three documents are required for it. These documents are: 1) Certificate of birth of the girl child – provided by the hospital where the child is born or even a certificate provided by a government official. 2) Address proof of the parents or legal guardian of the girl child – could be any one like passport, driving license, electricity or telephone bill, election ID card, ration card or any other address proof issued by the Government of India. 3) Identity proof of the parents or legal guardian – Any of the documents mentioned in point 2 above, or documents like PAN card or matriculation certificate would be valid as an identity proof for opening the account. An account once opened can also be transferred anywhere in India.

The role of legal guardian in the scheme would only come into picture wherein both the parents of the girl child are dead, or are not capable of opening or running the account. It is important to mention here that the girl child in whose name the account has been opened can operate the account on her after she attains the age of 10 years, if she wishes to do so.

Despite being a small investment scheme, an initiative like the Sukanya Samriddhi Account is the need of the hour and will go a long way towards protecting the future of and providing financial security to the girl child.

Source: PIB