Net Indirect Tax collections represent 108.2 percent of the Revised Estimates of Rs. 9.89 lakh crore of Indirect Taxes for the F.Y. 2020-21.

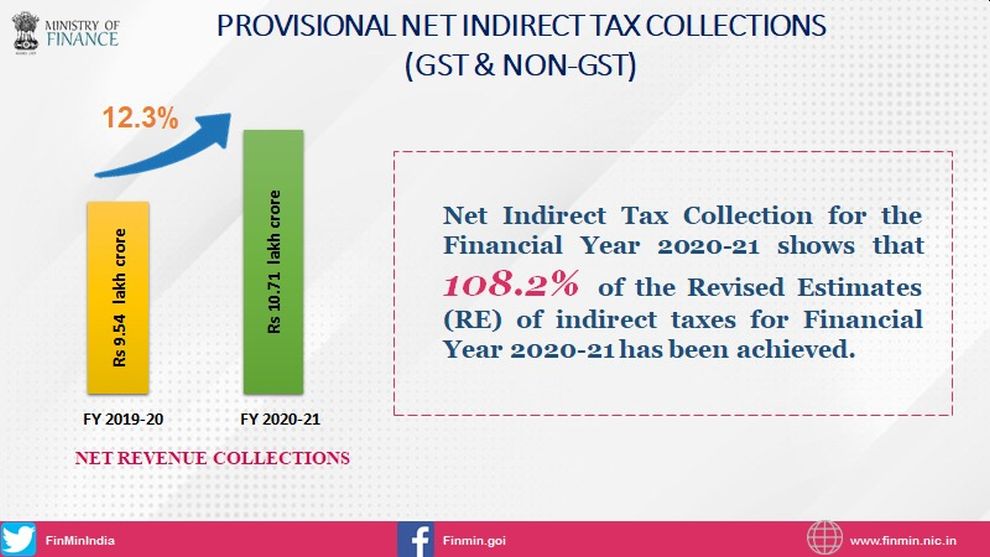

New Delhi: The provisional figures for indirect tax collections (GST & non-GST) for the Financial Year 2020-21 show that net revenue collections are at Rs 10.71 lakh crore as compared to 9.54 lakh Crore for the Financial Year 2019-20, thereby registering a growth of 12.3 percent.

As per the statement of the Ministry of Finance, Net Indirect Tax Collection for the Financial Year 2020-21 shows that 108.2 percent of the Revised Estimates of indirect taxes for Financial Year 2020-21 has been achieved.

As regards customs, net tax collections stood at Rs. 1.32 lakh crore during Financial Year 2020-21 as compared to Rs.1.09 lakh crore during the previous Financial Year, thereby registering a growth of around 21 percent, the Ministry further revealed.

Net Tax collections on account of Central Excise and Service Tax (Arrears) during Financial Year 2020-21 stood at Rs. 3.91 lakh crore as compared to Rs.2.45 lakh crore in the previous Financial Year, thereby registering a growth of more than 59 percent.

Net Tax collections on account of GST of Centre (CGST+IGST+ Compensation Cess) during Financial Year 2020-21 is Rs. 5.48 lakh crore as compared to Rs. 5.99 lakh crore in the previous Financial Year. Revised estimates of Net GST collection including CGST and Compensation Cess for FY 2020-21 was Rs. 5.15 Lakh Crore, Thus, the actual net GST collections is 106 percent of total targeted collection, though these are 8 percent lower than the last FYs collection.

The GST collections were severely affected in the first half of the Financial year on account of Covid. However, in the second half, the GST collections registered a good growth and collections exceeded Rs 1 lakh crore in each of the last six months. March saw an all-time high of GST collection at Rs 1.24 lakh crore after very good figures in the month of January and February. Several measures taken by the Central Government helped in improving compliance in GST.