Himachal Pradesh is to join other five states to roll out intra-State e-way bills from April 20. Other states are Bihar, Jharkhand, Haryana, Tripura and Uttarakhand.

As per the decision of the GST Council, e-Way Bill system for all inter-State movement of goods has been rolled out from 01st April, 2018.

As on 15th April, 2018, e-Way Bill system for intra-State movement of goods has been rolled out in the States of Andhra Pradesh, Gujarat, Karnataka, Kerala, Telangana and Uttar Pradesh and now six other states including Himachal Pradesh, have been introduced with the system.

E-Way Bills are getting generated successfully and till 17th April, 2018 more than one crore thirty three lakh e-Way Bills have been successfully generated which includes more than six lakh e-Way Bills which have been generated for intra-State movement of goods from 15th to 17th of April, 2018.

With the roll-out of e-Way Bill system in these States, it is expected that trade and industry will be further facilitated insofar as the transport of goods is concerned, thereby eventually paving the way for a nation-wide single e-Way Bill system.

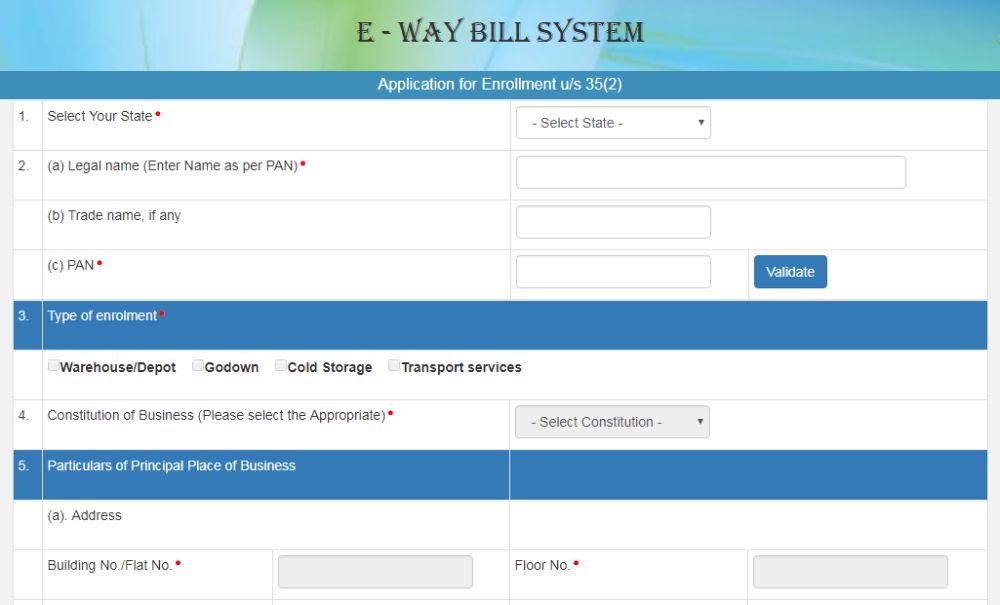

Trade and industry and transporters located in these States may obtain registration/enrolment on e-Way Bill portal (https://www.ewaybillgst.gov.in).

EWay Bill

The EWay Bill is an electronic way bill for movement of goods which can be generated on the eWay Bill Portal. Transport of goods of more than Rs. 50,000 (Single Invoice/bill/delivery challan) in value in a vehicle cannot be made by a registered person without an eway bill.

Alternatively, Eway bill can also be generated or cancelled through SMS, Android App and by Site-to-Site Integration (through API). When an eway bill is generated a unique eway bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.